Case Studies: Payer Strategy / Reimbursement Planning

Commercial

Strategy

Market

Research

Payer Strategy/

Reimbusement Planning

Business

Development

Competitive

Intelligence

Portfolio Planning/

Indication Scans

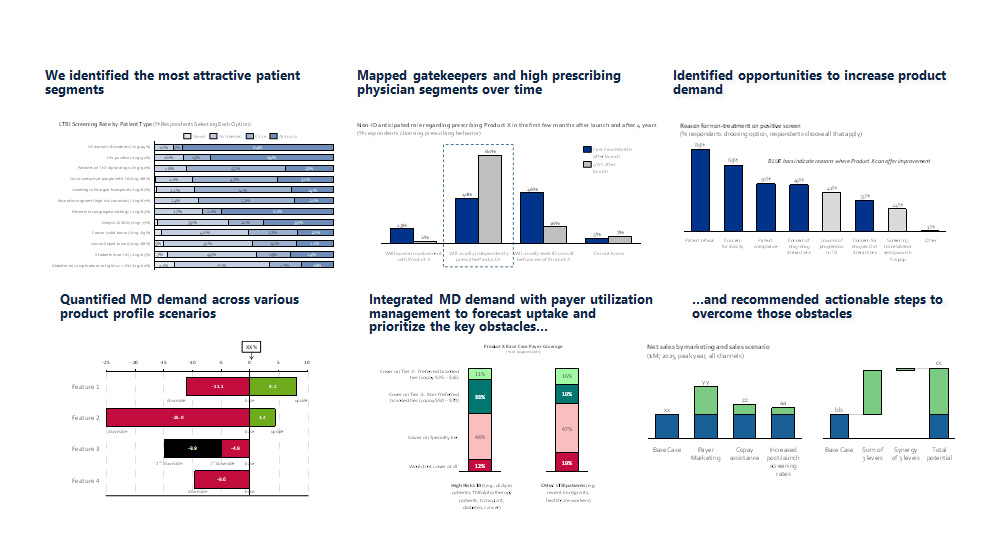

1. Case Study

Integrating physician and payer dynamics in infectious disease to arrive at a realistic peak year revenue

The Problem

- A top 50 global pharma company wanted to know how they could reach $500MM US peak sales for a Phase 2/3 asset treating latent tuberculosis infections (LTBI)

- In addition, they sought advice on how to re-frame the large and ill-defined literature prevalence to a more realistically addressable number of patients

What We Did

- Primary qualitative and quantitative market research (conjoint design) with physicians across 6 specialties (n=350), and payers (n=50)

- Market, revenue forecast, and business case (NPV) analysis

Analytically combined conjoint preferences across physicians and payers to represent the full buying process; identified a realistic path to $500MM

Our Results and Insights

- We identified the most attractive patient segments

- Mapped gatekeepers and high prescribing physician segments over time

- Identified opportunities to increase product demand

- Quantified MD demand across various product profile scenarios

- Integrated MD demand with payer utilization management to forecast uptake and prioritize the key obstacles…

- …and recommended actionable steps to overcome those obstacles

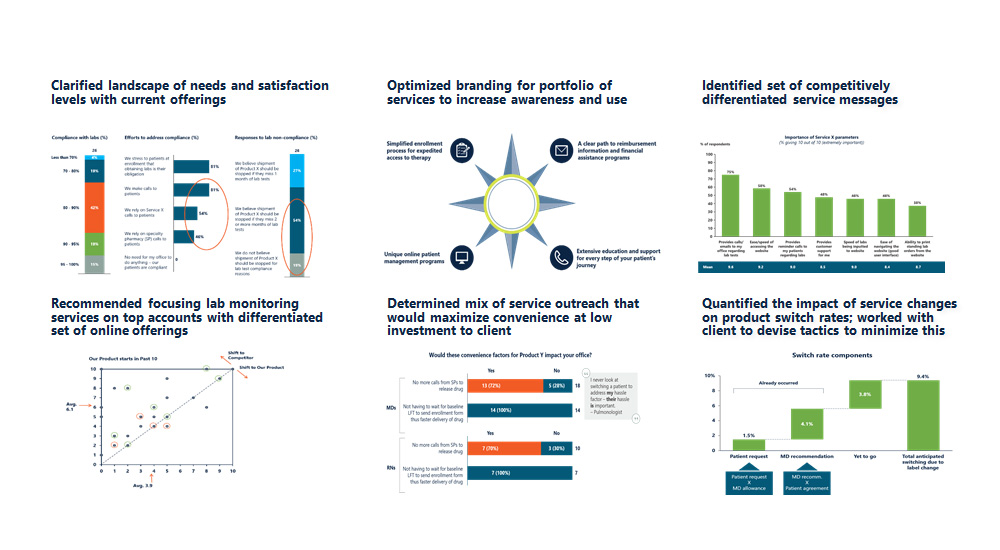

2. Case Study

Reimbursement support services optimization for orphan specialty product portfolio

The Problem

- A mid-sized pharmaceutical client desired multi-year support to help define, implement, and market a suite of reimbursement support services for their portfolio of premium-priced orphan specialty products

- Support services included enrollment, financial/ reimbursement, patient education, and monthly lab monitoring

- Therapeutic area highly competitive with multiple competitive launches expected during the project timeframe

What We Did

- 12 primary market research projects over a 3-year period across 4 stakeholder groups (physicians, nurses, payers, patients)

- Recommendations integrated findings across multiple channels (online, specialty distributor, and nurse visits)

- Helped increase compliance with treatment and lab monitoring

- Helped client maintain leadership position in highly competitive area

Our Results and Insights

- Clarified landscape of needs and satisfaction levels with current offerings

- Optimized branding for portfolio of services to increase awareness and use

- Identified set of competitively differentiated service messages

- Recommended focusing lab monitoring services on top accounts with differentiated set of online offerings

- Quantified the impact of service changes on product switch rates; worked with client to devise tactics to minimize this

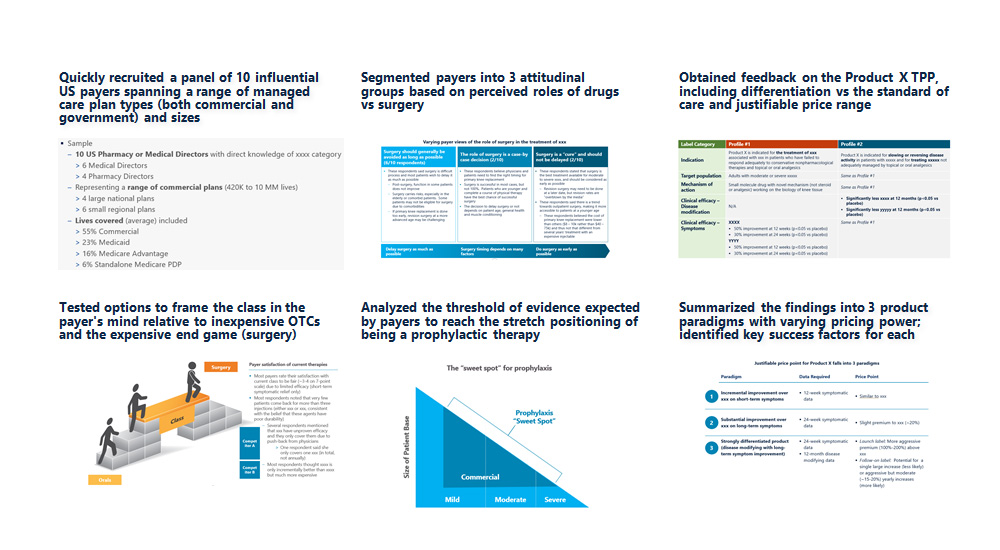

3. Case Study

Payer and reimbursement strategy for a novel mechanism; incremental value of a disease modification claim

The Problem

- A small public preclinical biotech client involved in a mass market desired to understand payer perceptions of current treatments, receptivity to a novel treatment (Product X), and justifiable pricing under two clinical scenarios: a symptomatic drug vs a disease modifying drug

- In addition, they sought to evaluate likely formulary placement and prior auth criteria, identify opportunities for price optimization, and identify meaningful endpoints for clinical and HEOR messaging

What We Did

- Qualitative market research with influential US payer decision-makers

- Clarified key aspects of the current landscape (drivers of the coverage decision, P&T review process, utilization management)

- Obtained feedback on the blinded TPP (differentiation, impact of various data elements, and thoughts on justifiable pricing levels, and likely controls (prior auth, step edits, etc.) at different price thresholds

- Summarized the findings into 3 paradigms with varying pricing power

Our Results and Insights

- Quickly recruited a panel of 10 influential US payers spanning a range of managed care plan types (both commercial and government) and sizes

- Segmented payers into 3 attitudinal groups based on perceived roles of drugs vs surgery

- Obtained feedback on the Product X TPP, including differentiation vs the standard of care and justifiable price range

- Tested options to frame the class in the payer’s mind relative to inexpensive OTCs and the expensive end game (surgery)

- Analyzed the threshold of evidence expected by payers to reach the stretch positioning of being a prophylactic therapy

- Summarized the findings into 3 product paradigms with varying pricing power; identified key success factors for each

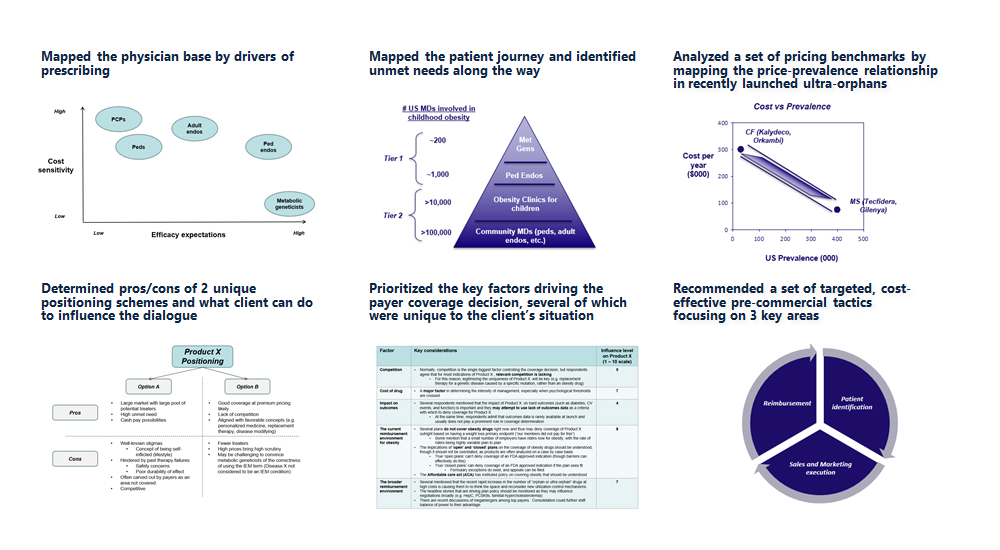

4. Case Study

Commercial strategy for a novel, ultra-orphan specialty drug: KOL and payer deep dive

The Problem

- A privately-held, development stage biotech company wanted to understand the prevalence and unmet needs of an ultra-orphan disease and how a new drug might be priced and positioned to optimize uptake

- More tactically, the team wanted to know how to identify these ultra-rare patients for clinical trials and commercialization

What We Did

- Primary research: Qualitative in-depth phone-Internet interviews with commercial payers and KOL specialists (geneticists and pediatric endos)

- Secondary research: Benchmarking analysis of ultra-orphan analogs for pricing, patient identification schemes and positioning. Created a Patient Journey that could be used to find high leverage points of patient identification

Our Results and Insights

- Mapped the physician base by drivers of prescribing

- Mapped the patient journey and identified unmet needs along the way

- Analyzed a set of pricing benchmarks by mapping the price-prevalence relationship in recently launched ultra-orphans

- Determined pros/cons of 2 unique positioning schemes and what client can do to influence the dialogue

- Prioritized the key factors driving the payer coverage decision, several of which were unique to the client’s situation

- Recommended a set of targeted, cost-effective pre-commercial tactics focusing on 3 key areas

5. Case Study

US launch planning and EU go/ no-go

View the Case

A small biotech company with a novel phase 3 asset desired a full slate of market feedback across physicians and payers (in the US) and Health Technology Assessment entities (HTAs; in the EU5) to help guide launch planning. Aquest planned out and executed an aggressive series of 5 inter-related primary market research assessments in a 2 month period, including quantitative US demand studies focused on the impact of payer utilization controls on physician and patient behavior, and how this translates to share uptake. In addition, we conducted a qualitative EU assessment (executed in collaboration with Aquest’s UK affiliate) focused on answering the go/ no-go decision in Europe by benchmarking pricing and coverage expectations (for a set of analogs and the profile of interest) and quantifying how these would translate to a revenue projection. Armed with this data, the client was able to make an informed decision regarding further EU investment as well as prepare for a successful US launch.

6. Case Study

Payer/ thought leader value proposition development

View the Case

A small specialty pharmaceutical company commissioned Aquest to interview large payers (pharmacy/medical directors at managed care companies and PBMs), thought leaders, and community physicians on a Phase II product they were considering acquiring. Aquest conducted telephone interviews with representatives from each group and provided the client with a clearly written report that warned of key potential strategic pitfalls, particularly in light of nascent trends within the therapeutic category.

7. Case Study

Market access/ clinical development strategy

View the Case

A public biotech commissioned Aquest to help determine how to most efficiently develop a compelling payer case for a phase 2 asset in the context of the remaining clinical trial work. They were considering whether to integrate utilization management and pharmacoeconomic data collection in phase 2b/3 studies or whether to conduct a separate, phase 4 “real world” trial for this purpose. Aquest conducted interviews with internal and external stakeholders and used this guidance to develop a set of decision analysis criteria that balanced time to market, budget constraints, clinical and regulatory risk, and a rapidly changing competitive landscape.

case studies

quick links

contact

NORTHERN CALIFORNIA

415.425.3201

mike@aquestconsulting.com

SOUTHERN CALIFORNIA

805.300.6912

reid@aquestresearch.com