Case Studies: Market Research

Commercial

Strategy

Market

Research

Payer Strategy/

Reimbusement Planning

Business

Development

Competitive

Intelligence

Portfolio Planning/

Indication Scans

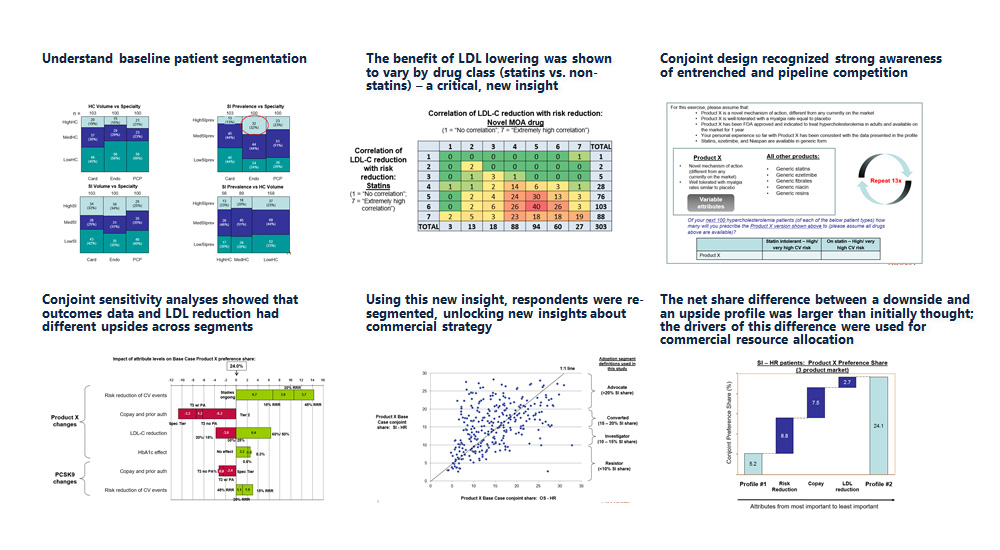

1. Case Study

Demand modeling and scenario planning for a novel, mass-market cardiovascular agent

The Problem

- A small but highly-valued biopharma client sought to quantify the opportunity for a new hypercholesterolemia product across 6 patient segments and 3 physician specialties

- More specifically, they wanted to know which product attributes will drive share uptake vs. the market-leading statins and the classes in late-stage development (PCSK9i and CETPi)

What We Did

- Hypothesized most likely competitive sets to orient around strategically

- We conducted a quantitative conjoint study with n=300 physicians across 3 specialties; as well as 20 qualitative payer interviews

- Using this primary data, we created an annual revenue forecast capable of flexible scenario planning

Our Results and Insights

- Understand baseline patient segmentation

- The benefit of LDL lowering was shown to vary by drug class (statins vs. non-statins) – a critical, new insight

- Conjoint design recognized strong awareness of entrenched and pipeline competition

- Conjoint sensitivity analyses showed that outcomes data and LDL reduction had different upsides across segments

- Using this new insight, respondents were re-segmented, unlocking new insights about commercial strategy

- The net share difference between a downside and an upside profile was larger than initially thought; the drivers of this difference were used for commercial resource allocation

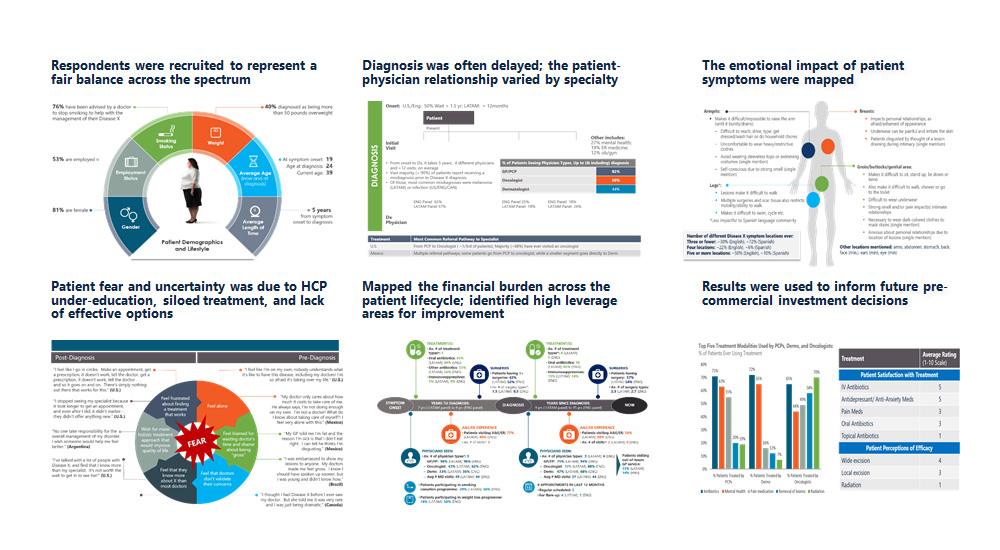

2. Case Study

Patient journey for an orphan disease state with multiple stakeholder touch points

The Problem

- A small public biotech company wished to increase their understanding of the patient experience for an orphan indication – including emotions and needs across the disease lifecycle

- In addition, they wished to identify sources of information patients use (pre- and post-diagnosis) and assess patients’ preferences for corporate resources

What We Did

- Qualitative primary research with patients was conducted to elucidate emotions and motivations around disease burden, financial pressures, flow through the healthcare system, and relationships with health care providers

- Secondary research was conducted to quantify the market characteristics

- Results were used to inform future pre-commercial investment decisions

Our Results and Insights

- Respondents were recruited to represent a fair balance across the spectrum

- Diagnosis was often delayed; the patient-physician relationship varied by specialty

- The emotional impact of patient symptoms were mapped

- Patient fear and uncertainty was due to HCP under-education, siloed treatment, and lack of effective options

- Mapped the financial burden across the patient lifecycle; identified high leverage areas for improvement

- Results were used to inform future pre-commercial investment decisions

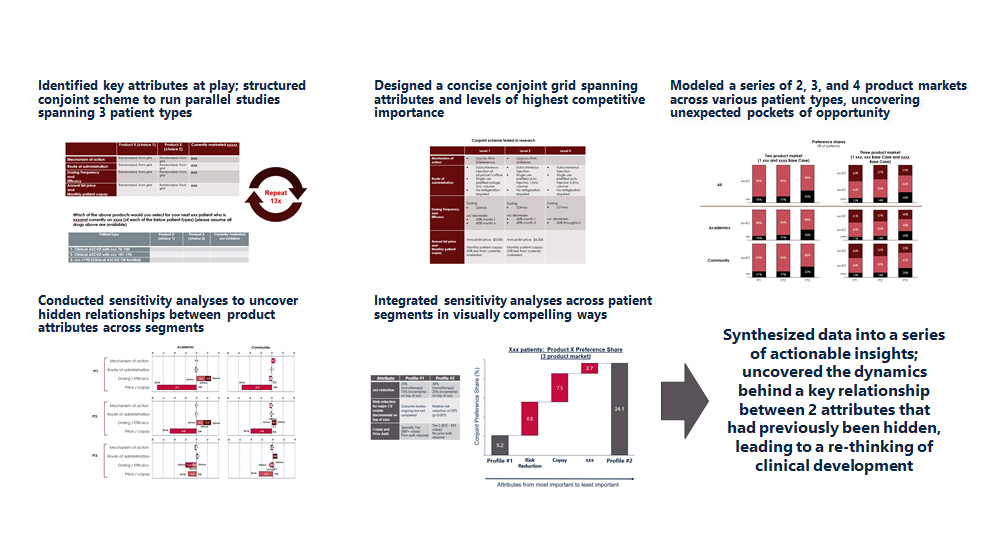

3. Case Study

Demand modeling for a novel RNA technology in a mass market: using conjoint to inform partnership discussions

The Problem

-

A small, privately held clinical stage biotech sought to quantify the dynamics at play in a mass market cardiovascular indication in the US, with an emphasis on a recently launched franchise that they would be competing against with their RNA technology

-

Their goal was to inform a launch forecast, clinical development decisions, and help in partnership negotiations

What We Did

- Designed and executed an Internet survey with academic and community cardiologists in the US

- Used conjoint to create a user-friendly “what-if” scenario modeling tool to forecast scenarios across various patient and physician segments in 2 and 3 and 4 product markets

- Uncovered the dynamics behind a key relationship between 2 product attributes that had previously been hidden, leading to a re-thinking of clinical development

Our Results and Insights

- Identified key attributes at play; structured conjoint scheme to run parallel studies spanning 3 patient types

- Designed a concise conjoint grid spanning attributes and levels of highest competitive importance

- Modeled a series of 2, 3, and 4 product markets across various patient types, uncovering unexpected pockets of opportunity

- Conducted sensitivity analyses to uncover hidden relationships between product attributes across segments

- Integrated sensitivity analyses across patient segments in visually compelling ways

- Synthesized data into a series of actionable insights; uncovered the dynamics behind a key relationship between 2 attributes that had previously been hidden, leading to a re-thinking of clinical development

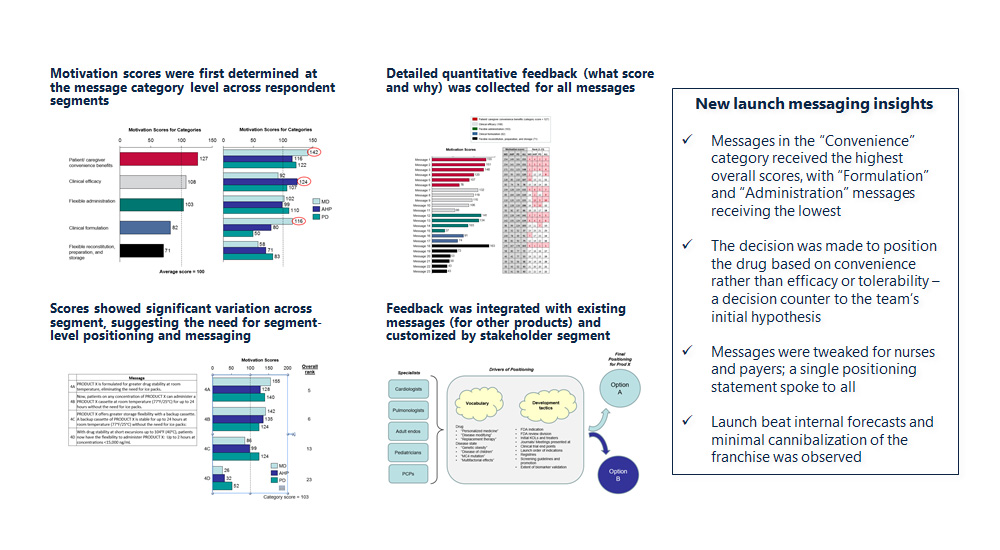

4. Case Study

Launch messaging and positioning for an orphan specialty product

The Problem

- A mid-sized pharma client wanted to evaluate quantitatively the impact of launch messaging and positioning for an orphan specialty product (messages spanned efficacy, safety, reimbursement, and enrollment)

- In addition, they wanted to ensure the messaging is complementary to the messaging for related products in their portfolio

What We Did

- Quantitative market research study with high-volume prescribing physicians, nurses, and pharmacy directors

- Maxdiff methodology was chosen to collect the large amount of feedback needed with low respondent fatigue

23 messages across 5 categories were examined and a positioning statement was devised

Our Results and Insights

- Motivation scores were first determined at the message category level across respondent segments

- Detailed quantitative feedback (what score and why) was collected for all messages

- Scores showed significant variation across segment, suggesting the need for segment-level positioning and messaging

- Feedback was integrated with existing messages (for other products) and customized by stakeholder segment

New launch messaging insights:

-

Messages in the “Convenience” category received the highest overall scores, with “Formulation” and

-

“Administration” messages receiving the lowestThe decision was made to position the drug based on convenience rather than efficacy or tolerability – a decision counter to the team’s initial hypothesis

-

Messages were tweaked for nurses and payers; a single positioning statement spoke to all

-

Launch beat internal forecasts and minimal cannibalization of the franchise was observed

5. Case Study

Reimbursement support services optimization for orphan specialty product portfolio

The Problem

- A mid-sized pharmaceutical client desired multi-year support to help define, implement, and market a suite of reimbursement support services for their portfolio of premium-priced orphan specialty products

- Support services included enrollment, financial/ reimbursement, patient education, and monthly lab monitoring

- Therapeutic area highly competitive with multiple competitive launches expected during the project timeframe

What We Did

- 12 primary market research projects over a 3-year period across 4 stakeholder groups (physicians, nurses, payers, patients)

- Recommendations integrated findings across multiple channels (online, specialty distributor, and nurse visits)

- Helped increase compliance with treatment and lab monitoring

- Helped client maintain leadership position in highly competitive area

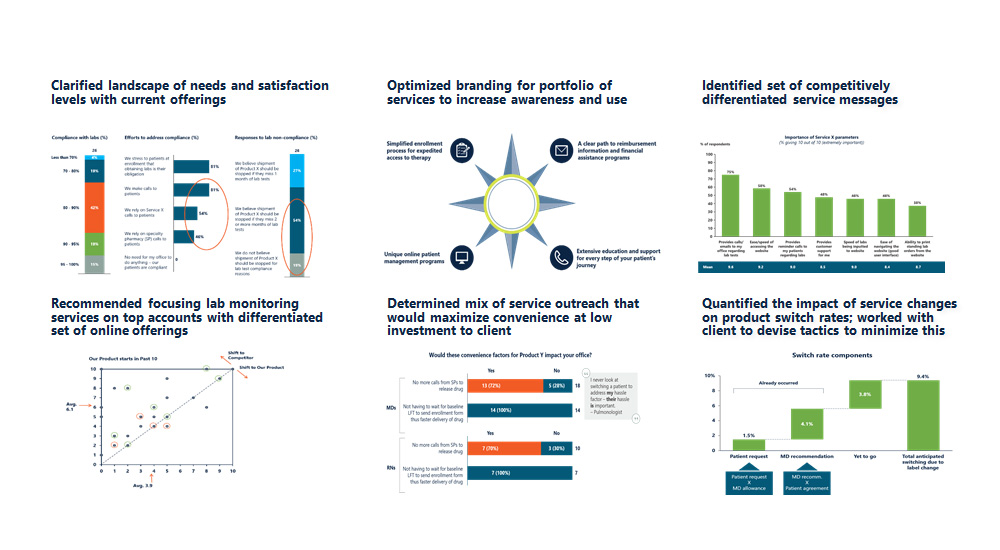

Our Results and Insights

- Clarified landscape of needs and satisfaction levels with current offerings

- Optimized branding for portfolio of services to increase awareness and use

- Identified set of competitively differentiated service messages

- Recommended focusing lab monitoring services on top accounts with differentiated set of online offerings

- Determined mix of service outreach that would maximize convenience at low investment to client

- Quantified the impact of service changes on product switch rates; worked with client to devise tactics to minimize this

6. Case Study

Diagnostic strategy for novel oncology drug (focus on next-generation sequencing (NGS) vs. IHC)

The Problem

- A mid size biotech company was developing a drug targeting a rare, pan-tumor cancer mutation and wanted a go-to-market diagnostic test strategy

- Specifically, they wanted to map the current usage and likely future adoption of different molecular diagnostic platforms (single analyte (IHC, ISH), NGS and liquid biopsy)

- They also wanted to quantify the impact of each of the future adoption scenarios on uptake of their agent, and who would need to be influenced for each

What We Did

- Determined treatment flow and current use of molecular diagnostics platforms

- Conducted primary market research with broad array of US stakeholders (oncologists, pathologists, and payers across several clinic business models)

- Mapped the adoption rate of diagnostic platforms (single analyte, NGS, liquid biopsy) in academic vs commercial laboratories, and how each scenario would affect product uptake of their novel agent

- Delivered a comprehensive companion diagnostic strategy to support launch in a pan-tumor indication

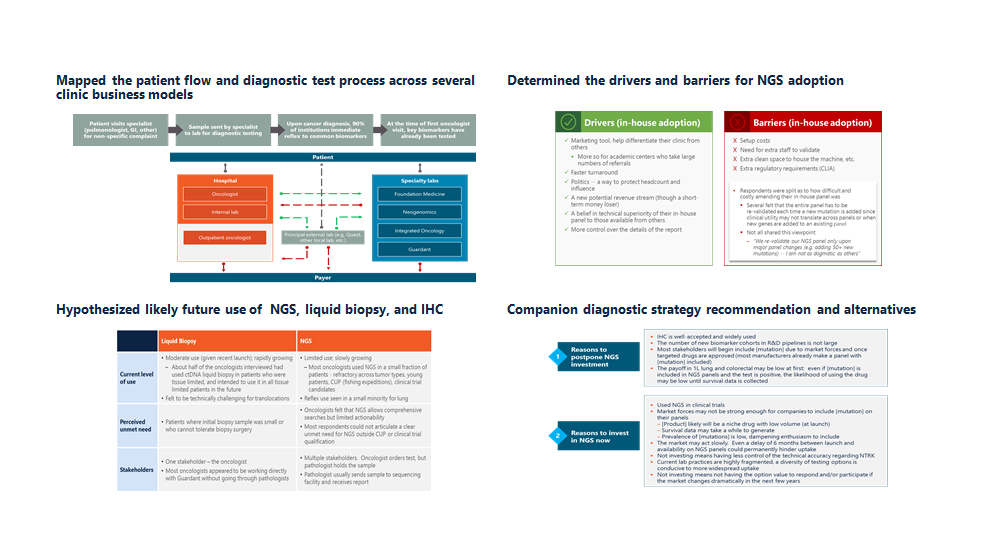

Our Results and Insights

- Mapped the patient flow and diagnostic test process across several clinic business models

- Determined the drivers and barriers for NGS adoption

- Hypothesized likely future use of NGS, liquid biopsy, and IHC

- Companion diagnostic strategy recommendation and alternatives

7. Case Study

Global oncology demand study and biomarker testing strategy for indication expansion

The Problem

- A large international pharmaceutical client wanted to measure and maximize demand for their novel targeted agent based on the completion of a Phase 3 global study in a new tumor type

- They wanted to estimate their product share by line of therapy, determine the source of business, develop a biomarker testing strategy and an attitudinal battery for customer typing. Their goal was to optimize how to position their product amidst a growing set of powerful competitors targeting overlapping biomarker profiles, including immunotherapy agents

What We Did

-

Mixture of global quantitative and qualitative research, spanning 7 countries (US, Asia, EU) and more than 400 respondents

-

Quantitatively determined across geographies: current practice patterns, anticipated share by line of therapy, source of business, biomarker testing rate, full attitudinal battery, drivers and barriers, and a physician and patient segmentation for use in future promotional targeting and positioning

-

Results informed future resource investment allocation decisions as well as future messaging and positioning efforts

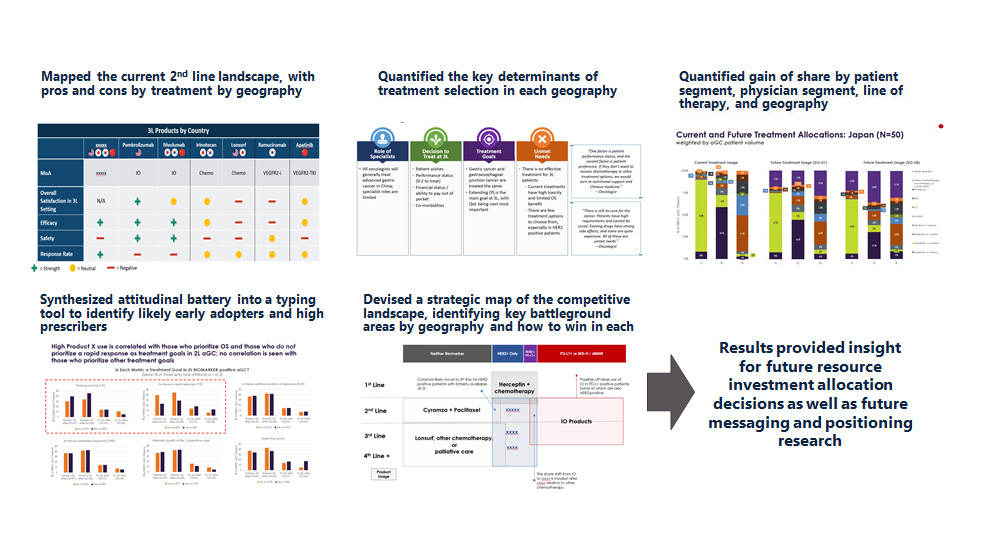

Our Results and Insights

- Mapped the current 2nd line landscape, with pros and cons by treatment by geography

- Quantified the key determinants of treatment selection in each geography

- Quantified gain of share by patient segment, physician segment, line of therapy, and geography

- Synthesized attitudinal battery into a typing tool to identify likely early adopters and high prescribers

- Devised a strategic map of the competitive landscape, identifying key battleground areas by geography and how to win in each

- Results provided insight for future resource investment allocation decisions as well as future messaging and positioning research

8. Case Study

Patient journey in a therapeutic area spanning cash-pay and insurance-pay drugs

The Problem

- A newly-public clinical stage biotech client desired a detailed patient journey to map the important touchpoints in a market that is highly patient driven and a mix of cash-pay and insurance-pay

- Client wanted to understand the high-leverage touchpoints, clinical decision-makers, and a high-level buying process in order to guide future clinical and pre-commercial investment decisions

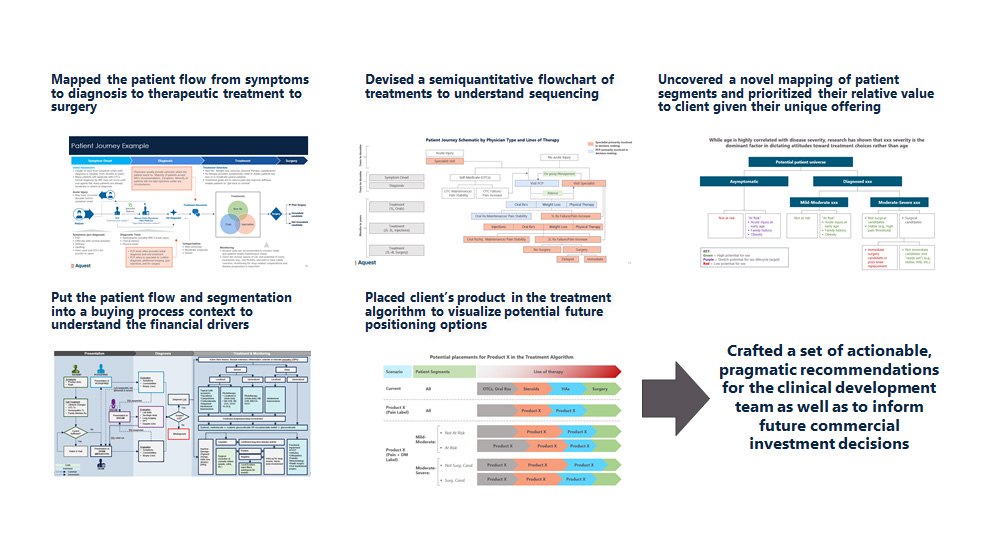

Our Results and Insights

- Mapped the patient flow from symptoms to diagnosis to therapeutic treatment to surgery

- Devised a semiquantitative flowchart of treatments to understand sequencing

- Uncovered a novel mapping of patient segments and prioritized their relative value to client given their unique offering

- Put the patient flow and segmentation into a buying process context to understand the financial drivers

- Placed client’s product in the treatment algorithm to visualize potential future positioning options

- Crafted a set of actionable, pragmatic recommendations for the clinical development team as well as to inform future commercial investment decisions

What We Did

- Combined primary and secondary data sources (qualitative market research with clinicians, payers and patients, scientific literature and payer literature) to triangulate on a semi-quantitative patient journey map

- Uncovered a complex flow that spanned several clinician types, several broad classes of competitors (devices and drugs, OTC and prescription), and 2 main reimbursement models (cash-pay and reimbursed)

- Identified opportunities to position client’s drug. Results served to inform future clinical and commercial investment decisions

9. Case Study

Launch demand study in niche hematology oncology indication

The Problem

- A small biotech client had recently completed Phase 3 study of their lead asset and was preparing to file for FDA approval in a niche hematology oncology indication

- The company sought to clarify patient segments, quantify expected treatment outcomes, assess physician reactions to the asset and the importance of its mechanism of action, and understand what drives physician decisions to taper dose

What We Did

- Conducted 32 qualitative, in-depth KOL interviews and 150 quantitative on-line surveys with hemoncs, segmented by location of care

- Analysis included: patient segments and lines of therapy, treatments and response rates, likelihood to prescribe, and drug attribute importance by segment

- Final recommendations were pragmatic and helped guide launch investment allocation decisions

Our Results and Insights

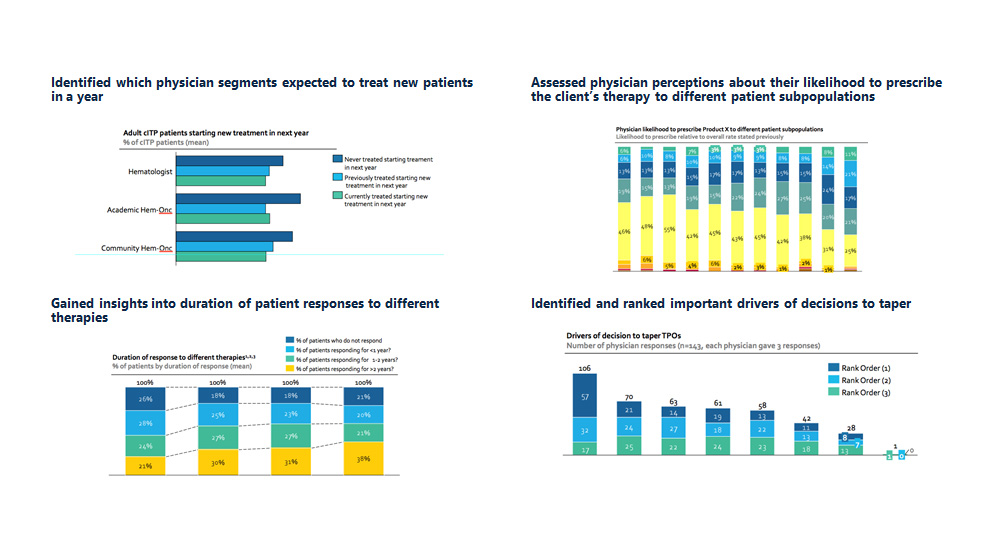

- Identified which physician segments expected to treat new patients in a year

- Assessed physician perceptions about their likelihood to prescribe the client’s therapy to different patient subpopulations

- Gained insights into duration of patient responses to different therapies

- Identified and ranked important drivers of decisions to taper

10. Case Study

Global quantitative study to optimize advertising concepts for wound care support services

The Problem

- A global leader in wound care wanted to assess three advertising concepts globally and determine which was most effective at communicating key messages related to service and support

- Concept needed to be effective across a variety of HCP types and across multiple geographies

What We Did

-

Conducted quantitative research to determine best concept across 7 metrics across all geographies along with overall preference

-

Analyzed open-ended responses to identify most important areas for concept improvement

-

Identified country-level and segment level differences that informed more targeted campaigns; concept was considered a significant driver of future

Our Results and Insights

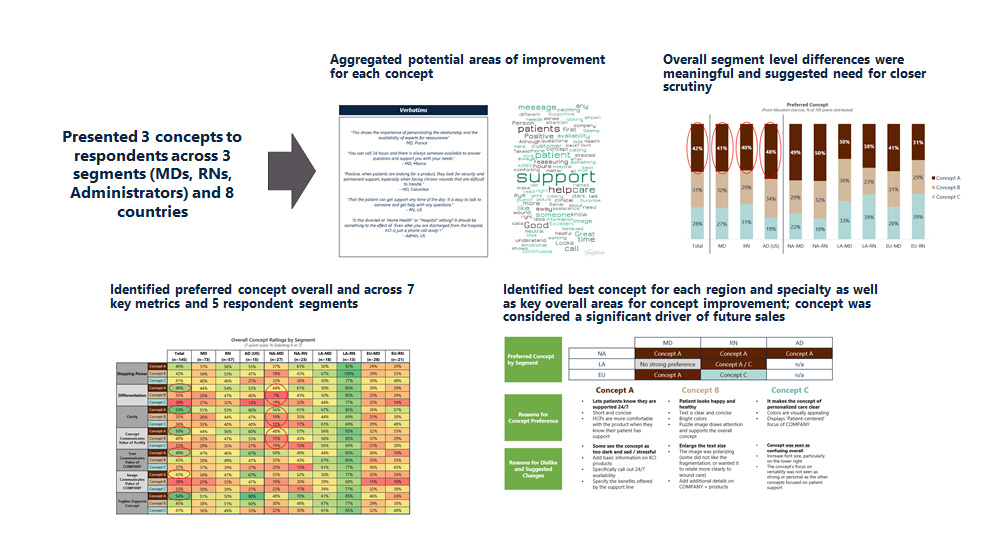

- Presented 3 concepts to respondents across 3 segments (MDs, RNs, Administrators) and 8 countries

- Aggregated potential areas of improvement for each concept

- Overall segment level differences were meaningful and suggested need for closer scrutiny

- Identified preferred concept overall and across 7 key metrics and 5 respondent segments

- Identified best concept for each region and specialty as well as key overall areas for concept improvement; concept was considered a significant driver of future sales

11. Case Study

Franchise positioning and messaging: unlocking the power of a portfolio using a linchpin product

The Problem

- A mid-sized medical device client sought to understand the drivers of product selection in wound care and how to leverage its portfolio to increase product usage across categories

- To achieve this, they wanted to understand how physicians and nurses assess and treat wounds across a wide range of patient segments and locations of care

- In addition, they sought to develop a series of core messages and visuals to differentiate their portfolio and increase share

What We Did

- Conducted a brainstorming workshop with client to generate a series of hypotheses regarding customer pain points, the product selection process, and messaging / positioning of both the franchise and products

- Executed 25 qualitative interviews across 2 treater segments (MDs and RNs) and 2 locations of care (acute and post-acute)

- Uncovered a key dynamic in the product selection process that could be used to guide messaging, positioning, and portfolio strategy

Our Results and Insights

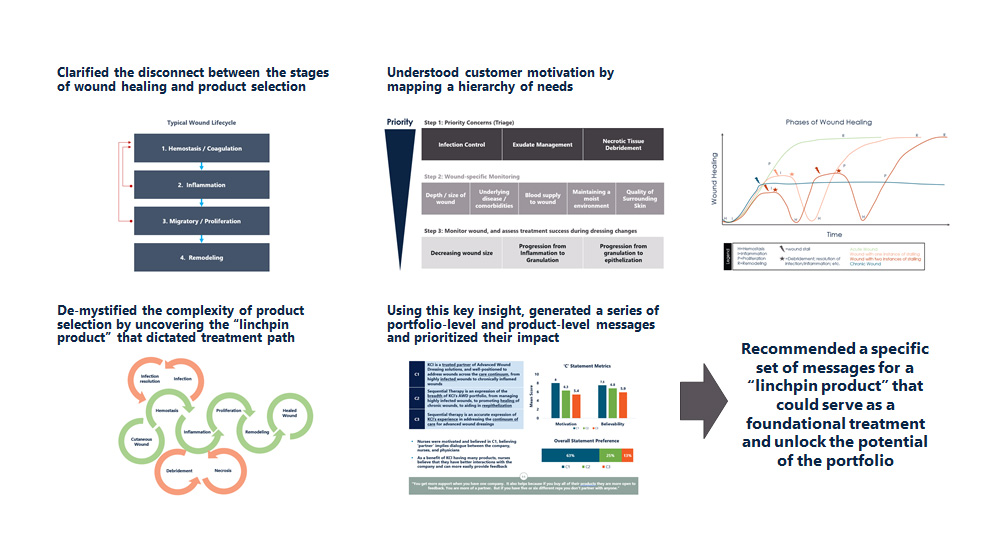

- Clarified the disconnect between the stages of wound healing and product selection

- Understood customer motivation by mapping a hierarchy of needs

- Mapped the wound lifecycle and clarified its impact on wound care treatment

- De-mystified the complexity of product selection by uncovering the “linchpin product” that dictated treatment path

- Using this key insight, generated a series of portfolio-level and product-level messages and prioritized their impact

- Recommended a specific set of messages for a “linchpin product” that could serve as a foundational treatment and unlock the potential of the portfolio

12. Case Study

Integrating physician and payer dynamics in infectious disease to arrive at a realistic peak year revenue

The Problem

- A top 50 global pharma company wanted to know how they could reach $500MM US peak sales for a Phase 2/3 asset treating latent tuberculosis infections (LTBI)

- In addition, they sought advice on how to re-frame the large and ill-defined literature prevalence to a more realistically addressable number of patients

What We Did

- Primary qualitative and quantitative market research (conjoint design) with physicians across 6 specialties (n=350), and payers (n=50)

- Market, revenue forecast, and business case (NPV) analysis

Analytically combined conjoint preferences across physicians and payers to represent the full buying process; identified a realistic path to $500MM

Our Results and Insights

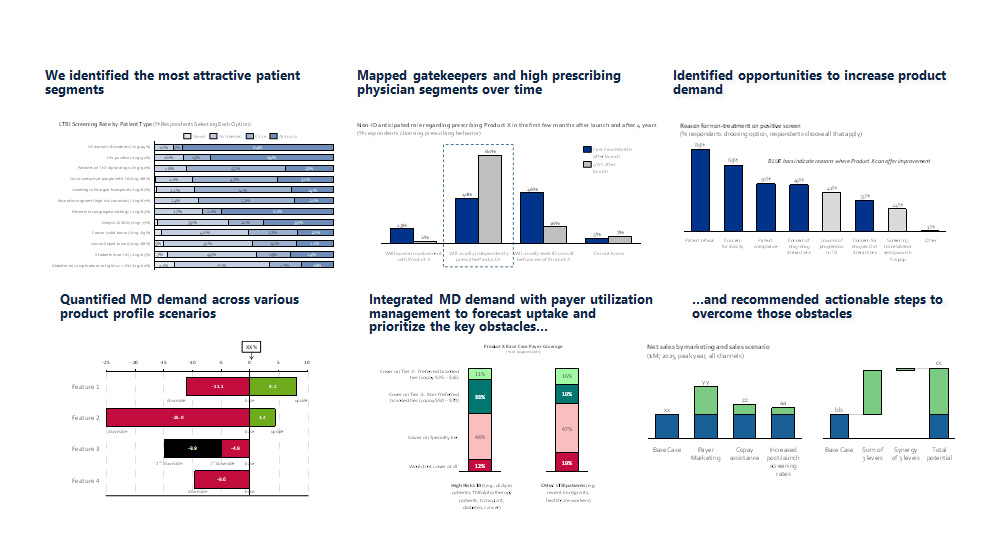

- We identified the most attractive patient segments

- Mapped gatekeepers and high prescribing physician segments over time

- Identified opportunities to increase product demand

- Quantified MD demand across various product profile scenarios

- Integrated MD demand with payer utilization management to forecast uptake and prioritize the key obstacles…

- …and recommended actionable steps to overcome those obstacles

13. Case Study

War gaming (competitive simulation)

View the Case

A mid-sized biopharma company with a successful specialty product was facing a competitive launch for the first time from an aggressive competitor and wanted to refine and pressure-test their messages and objection handlers in a real-world simulation. Aquest designed and moderated a series of 90 minute 1-on-1 sessions with physicians, playing the role of moderator, sales rep A, and sales rep B sequentially, for a truly controlled experiment. Recommendations were rolled out at the next POA meeting, ensuring a well-prepared field force.

14. Case Study

Publication Strategy

View the Case

A large biotechnology company decided to re-evaluate the investments it made in publications, both advertising and research articles. They commissioned Aquest to conduct a large quantitative survey with community oncologists, nurses, and clinical pharmacists to learn not only the publications they respected most, but also the publications they read most. The research uncovered new avenues for more productive advertising and article placement, offering the potential for hundreds of thousands of dollars in savings on publication investments.

case studies

quick links

contact

NORTHERN CALIFORNIA

415.425.3201

mike@aquestconsulting.com

SOUTHERN CALIFORNIA

805.300.6912

reid@aquestresearch.com