Case Studies: Competitive Intelligence

Commercial

Strategy

Market

Research

Payer Strategy/

Reimbusement Planning

Business

Development

Competitive

Intelligence

Portfolio Planning/

Indication Scans

1. Case Study

Competitive intelligence monitoring in irritable bowel disease; using a suite of proprietary tools

The Problem

- A preclinical biotech client desired a comprehensive process for competitive intelligence monitoring of a highly active therapeutic area, complete with clinical trial details and results, upcoming milestones and news flow tracking

- The process needed to succinctly and compellingly communicate the highest impact items as well as the changes since the last update

- The output should be usable across a wide range of audiences, from the Board of Directors to internal clinical team meetings

What We Did

- We worked with the client to identify a set of ~100 programs to be tracked and divided them into tiers based on threat level and intensity of monitoring desired

- Using a suite of proprietary tools, we created a set of visually attractive, information-dense slides as well as a process for quarterly monitoring for the milestones, news events, clinical trial design details, and clinical trial results for each tier of competitor

Our Results and Insights

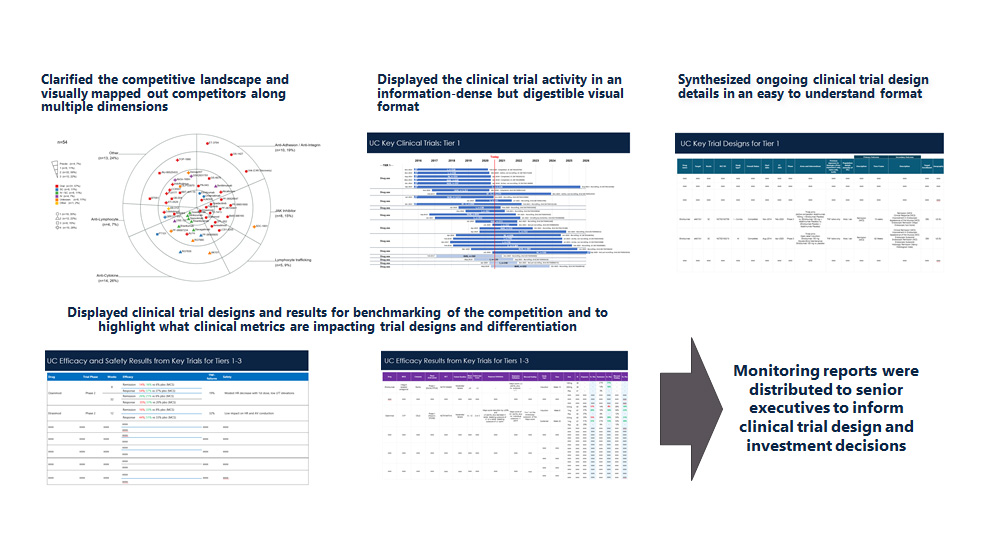

- Clarified the competitive landscape and visually mapped out competitors along multiple dimensions

- Displayed the clinical trial activity in an information-dense but digestible visual format

- Synthesized ongoing clinical trial design details in an easy to understand format

- Displayed clinical trial designs and results for benchmarking of the competition and to highlight what clinical metrics are impacting trial designs and differentiation

- Monitoring reports were distributed to senior executives to inform clinical trial design and investment decisions

2. Case Study

Portfolio-wide competitive intelligence monitoring

The Problem

- A mid-sized biotech client had a deep portfolio of clinical stage and marketed products across several highly competitive therapeutic areas and desired a more systematic process to monitoring the competition, both commercially and clinically

- As part of the process, client also wanted high-level revenue forecasts for the important competition in each therapeutic area

What We Did

- We conducted a broad range of secondary research (using proprietary databases, SEC filings, scientific publications) to inform a process for comprehensively monitoring each therapeutic area. Full reports were generated on a quarterly basis; targeted deeper dives more frequently

- We helped the client prioritize follow-on initiatives (e.g. market research, further clinical work) to optimize portfolio positioning

Our Results and Insights

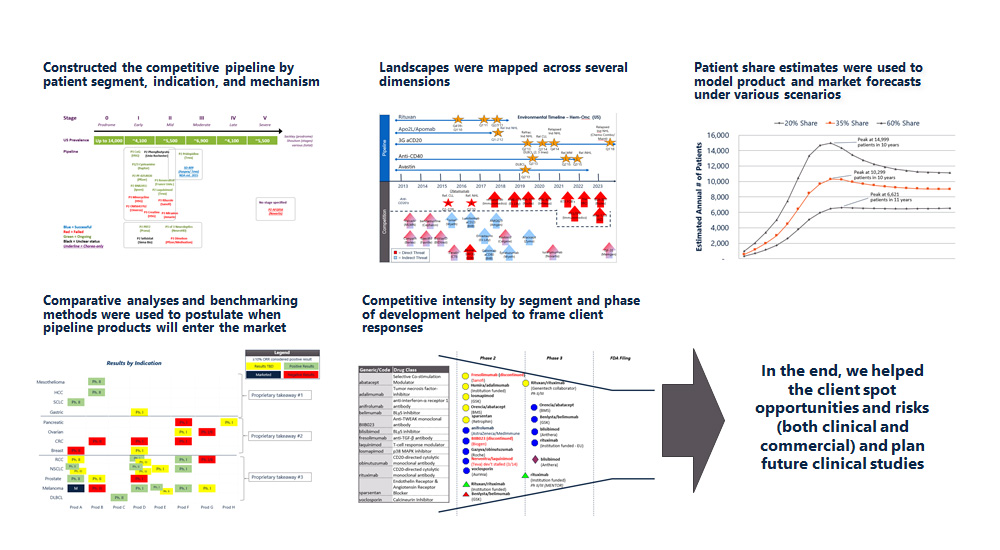

- Constructed the competitive pipeline by patient segment, indication, and mechanism

- Landscapes were mapped across several dimensions

- Patient share estimates were used to model product and market forecasts under various scenarios

- Comparative analyses and benchmarking methods were used to postulate when pipeline products will enter the market

- Competitive intensity by segment and phase of development helped to frame client responses

- In the end, we helped the client spot opportunities and risks (both clinical and commercial) and plan future clinical studies

case studies

quick links

contact

NORTHERN CALIFORNIA

415.425.3201

mike@aquestconsulting.com

SOUTHERN CALIFORNIA

805.300.6912

reid@aquestresearch.com