Case Studies: Commercial Strategy

Commercial

Strategy

Market

Research

Payer Strategy/

Reimbusement Planning

Business

Development

Competitive

Intelligence

Portfolio Planning/

Indication Scans

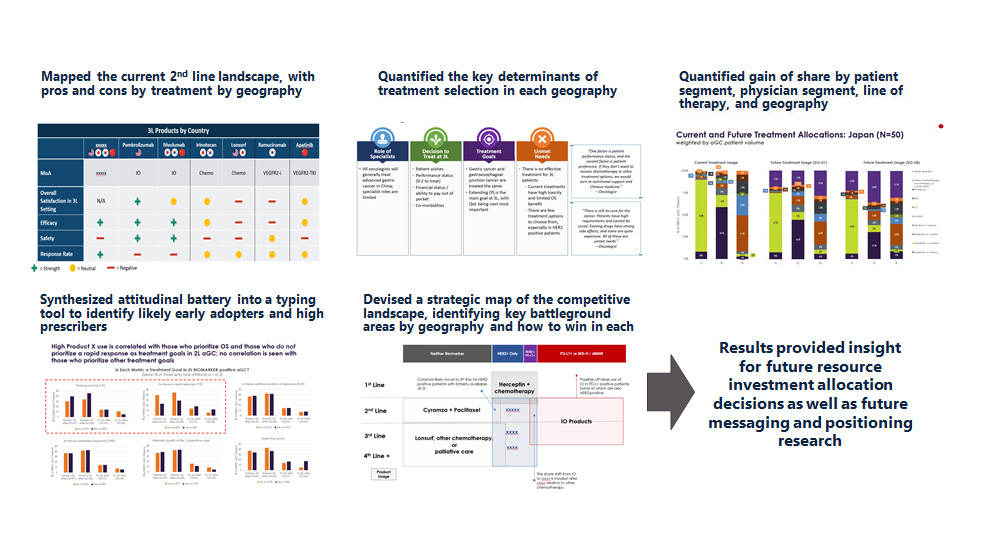

1. Case Study

Global oncology demand study and biomarker testing strategy for indication expansion

The Problem

- A large international pharmaceutical client wanted to measure and maximize demand for their novel targeted agent based on the completion of a Phase 3 global study in a new tumor type

- They wanted to estimate their product share by line of therapy, determine the source of business, develop a biomarker testing strategy and an attitudinal battery for customer typing. Their goal was to optimize how to position their product amidst a growing set of powerful competitors targeting overlapping biomarker profiles, including immunotherapy agents

What We Did

-

Mixture of global quantitative and qualitative research, spanning 7 countries (US, Asia, EU) and more than 400 respondents

-

Quantitatively determined across geographies: current practice patterns, anticipated share by line of therapy, source of business, biomarker testing rate, full attitudinal battery, drivers and barriers, and a physician and patient segmentation for use in future promotional targeting and positioning

-

Results informed future resource investment allocation decisions as well as future messaging and positioning efforts

Our Results and Insights

- Mapped the current 2nd line landscape, with pros and cons by treatment by geography

- Quantified the key determinants of treatment selection in each geography

- Quantified gain of share by patient segment, physician segment, line of therapy, and geography

- Synthesized attitudinal battery into a typing tool to identify likely early adopters and high prescribers

- Devised a strategic map of the competitive landscape, identifying key battleground areas by geography and how to win in each

- Results provided insight for future resource investment allocation decisions as well as future messaging and positioning research

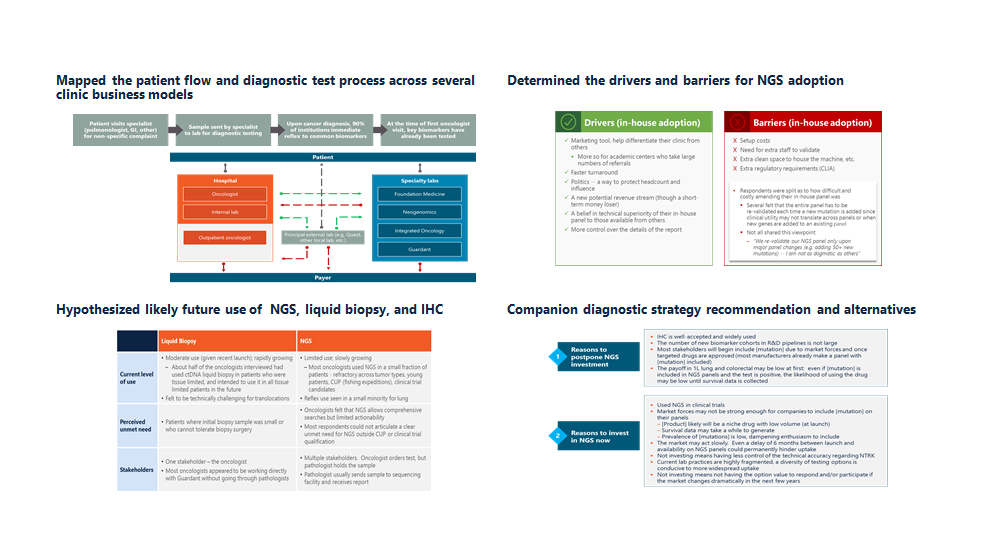

2. Case Study

Diagnostic strategy for novel oncology drug (focus on next-generation sequencing (NGS) vs. IHC)

The Problem

- A mid size biotech company was developing a drug targeting a rare, pan-tumor cancer mutation and wanted a go-to-market diagnostic test strategy

- Specifically, they wanted to map the current usage and likely future adoption of different molecular diagnostic platforms (single analyte (IHC, ISH), NGS and liquid biopsy)

- They also wanted to quantify the impact of each of the future adoption scenarios on uptake of their agent, and who would need to be influenced for each

What We Did

- Determined treatment flow and current use of molecular diagnostics platforms

- Conducted primary market research with broad array of US stakeholders (oncologists, pathologists, and payers across several clinic business models)

- Mapped the adoption rate of diagnostic platforms (single analyte, NGS, liquid biopsy) in academic vs commercial laboratories, and how each scenario would affect product uptake of their novel agent

- Delivered a comprehensive companion diagnostic strategy to support launch in a pan-tumor indication

Our Results and Insights

- Mapped the patient flow and diagnostic test process across several clinic business models

- Determined the drivers and barriers for NGS adoption

- Hypothesized likely future use of NGS, liquid biopsy, and IHC

- Companion diagnostic strategy recommendation and alternatives

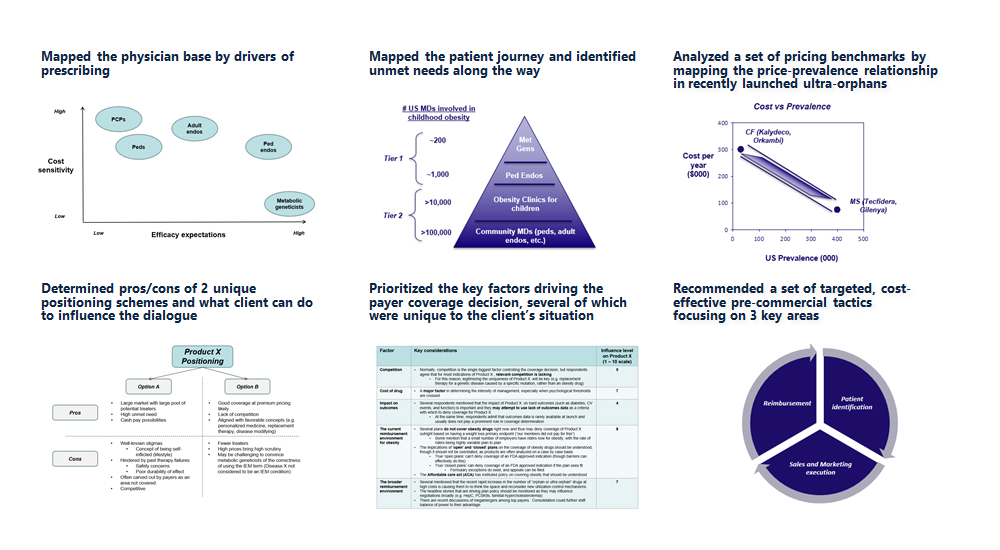

3. Case Study

Commercial strategy for a novel, ultra-orphan specialty drug: KOL and payer deep dive

The Problem

- A privately-held, development stage biotech company wanted to understand the prevalence and unmet needs of an ultra-orphan disease and how a new drug might be priced and positioned to optimize uptake

- More tactically, the team wanted to know how to identify these ultra-rare patients for clinical trials and commercialization

What We Did

- Primary research: Qualitative in-depth phone-Internet interviews with commercial payers and KOL specialists (geneticists and pediatric endos)

- Secondary research: Benchmarking analysis of ultra-orphan analogs for pricing, patient identification schemes and positioning. Created a Patient Journey that could be used to find high leverage points of patient identification

Our Results and Insights

- Mapped the physician base by drivers of prescribing

- Mapped the patient journey and identified unmet needs along the way

- Analyzed a set of pricing benchmarks by mapping the price-prevalence relationship in recently launched ultra-orphans

- Determined pros/cons of 2 unique positioning schemes and what client can do to influence the dialogue

- Prioritized the key factors driving the payer coverage decision, several of which were unique to the client’s situation

- Recommended a set of targeted, cost-effective pre-commercial tactics focusing on 3 key areas

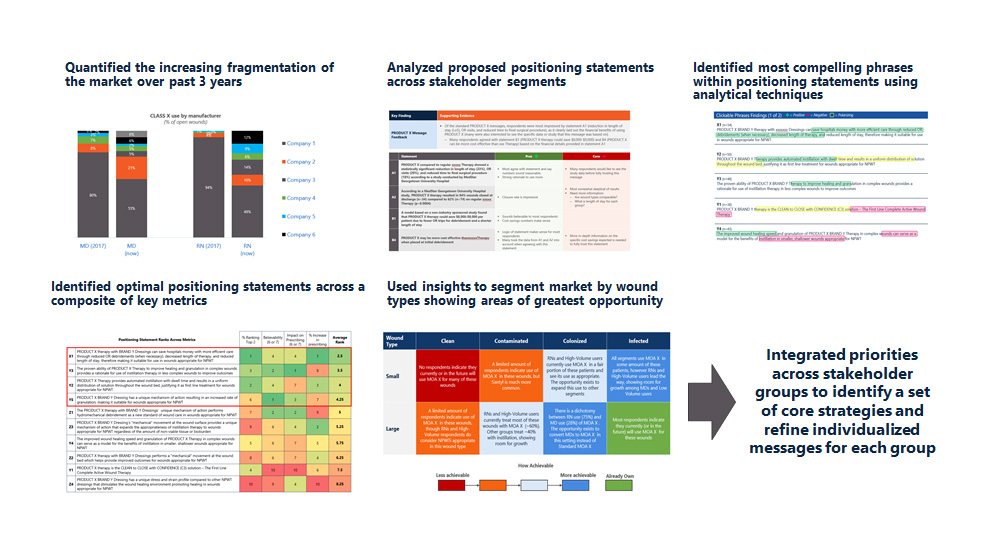

4. Case Study

Market segmentation and commercial strategy for specialized medical device company

The Problem

- A global leader in wound care wanted to assess current practices and determine the optimal competitive strategy to position their new technology beyond its current niche

- In addition, they wanted to understand how to position their highly differentiated clinical positioning across a broad range of stakeholders that influence the buying decision, including clinical, administrative, and financial personnel

What We Did

-

Conducted qualitative and quantitative research across multiple stakeholders (physicians, nurses, payers, administrators, c-suite) to understand current practices and drivers of use, market segments by wound type, and highlighting areas of greatest opportunity for expansion

-

Integrated priorities across stakeholder groups to identify a set of core strategies as well as individualized messages for each group

Our Results and Insights

- Quantified the increasing fragmentation of the market over past 3 years

- Analyzed proposed positioning statements across stakeholder segments

- Identified most compelling phrases within positioning statements using analytical techniques

- Identified optimal positioning statements across a composite of key metrics

- Used insights to segment market by wound types showing areas of greatest opportunity

- Integrated priorities across stakeholder groups to identify a set of core strategies and refine individualized messages for each group

5. Case Study

Global commercial strategy for a leading medical device client focused on wound care

The Problem

- A global leader in wound care wanted to assess current practices and determine the optimal competitive strategy to position their fast-selling specialized medical device beyond its current niche

- In addition, they wanted to understand the impact of potential investments in new technology and clinical studies on perceptions and uptake of their product

What We Did

- Conducted global qualitative interviews with several stakeholder groups (patients, physicians, administrators) to understand current practices and drivers of use, as well as gauge receptiveness to expanding use

- Conducted quantitative research to quantify current use, attitudes towards the product, and reactions to positioning statements

- Identified optimal positioning statements and segmented market by wound type, showing areas of greatest opportunity for expansion

Our Results and Insights

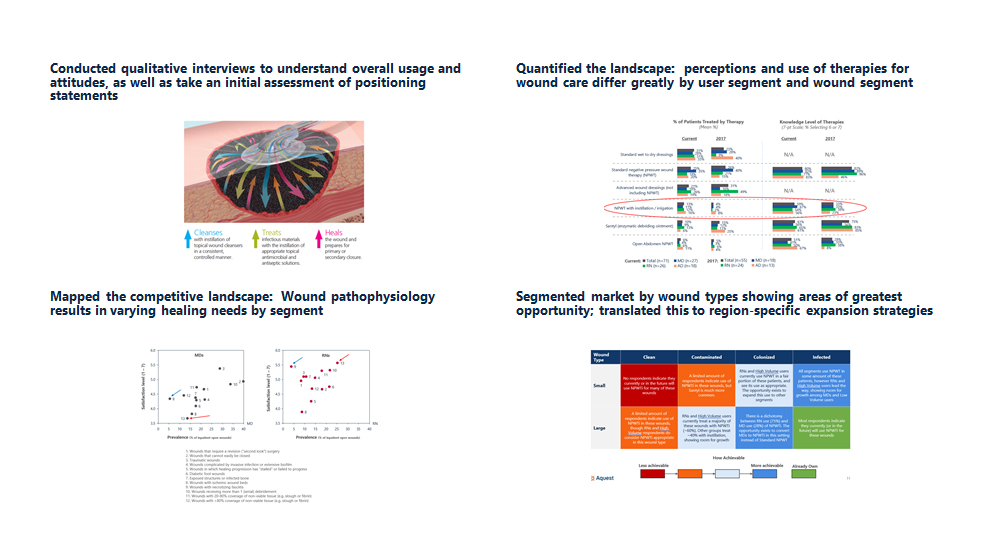

- Conducted qualitative interviews to understand overall usage and attitudes, as well as take an initial assessment of positioning statements

- Quantified the landscape: perceptions and use of therapies for wound care differ greatly by user segment and wound segment

- Mapped the competitive landscape: Wound pathophysiology results in varying healing needs by segment

- Segmented market by wound types showing areas of greatest opportunity; translated this to region-specific expansion strategies

6. Case Study

Business case for a portfolio of novel anti-influenza biologics

The Problem

- A large global pharma company wanted to know how attractive the business case is for developing novel biologic drugs against influenza strains

- In addition, they sought to clarify the development strategy that would optimize the value of these assets

What We Did

- Led cross-functional team to build draft revenue forecast, create high-level clinical development plan, & assess technical risk

- Led meta-analysis efforts to determine potential hurdle values for novel clinical trial endpoints

- Led revenue and NPV investment scenario analysis to understand strategic implications

Our Results and Insights

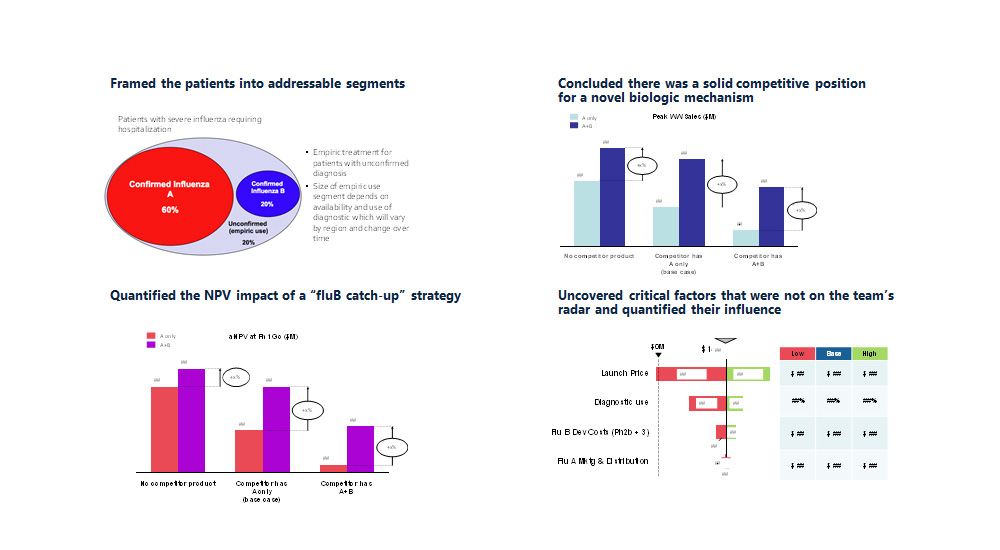

- Framed the patients into addressable segments

- Concluded there was a solid competitive position for a novel biologic mechanism

- Quantified the NPV impact of a “fluB catch-up” strategy

- Uncovered critical factors that were not on the team’s radar and quantified their influence

7. Case Study

Commercial launch planning: Project playbook across marketing, sales, distribution, and reimbursement

The Problem

- A small but late-stage clinical global pharmaceutical client desired help in framing a pathway of projects and priorities in the 2 years leading up to launch of their first drug in a highly competitive area

- They sought help in differentiating the must-haves from the nice-to-haves and in understanding the costs, timing and interrelationships of projects across departments

What We Did

- Lead several working sessions with the client to understand budget, clinical timelines, and launch priorities at a high level

- Used a combination of analogs, benchmarks, secondary data, and primary research (with clinical and commercial experts) to map out a comprehensive set of projects by department and by year to optimize uptake

- Devised a roadmap to ensure client maintains leadership position in a highly competitive area

Our Results and Insights

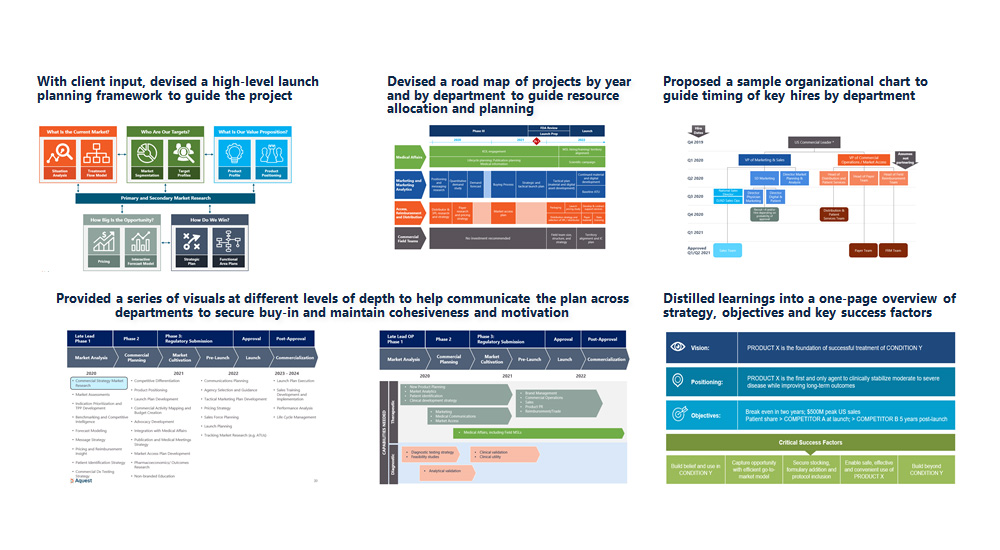

- With client input, devised a high-level launch planning framework to guide the project

- Devised a road map of projects by year and by department to guide resource allocation and planning

- Proposed a sample organizational chart to guide timing of key hires by department

- Provided a series of visuals at different levels of depth to help communicate the plan across departments to secure buy-in and maintain cohesiveness and motivation

- Distilled learnings into a one-page overview of strategy, objectives and key success factors

8. Case Study

Target product profile (TPP) creation

View the Case

A mid-sized biotech company had just filed an IND for a promising compound that had potential use across a variety of therapeutic niches. Aquest was commissioned to formulate compelling TPPs for each indication (including a vision statement, strategic rationale, differentiation from competition, and peak year sales forecast) and to work with an internal project team (comprised of regulatory, preclinical/ PK, and clinical groups) to undergo a disciplined decision analysis process of selecting the most promising TPPs to guide clinical development strategy.

9. Case Study

Patient registry development

View the Case

A small private biotech company was developing a drug in a therapeutic area that had never been reviewed by the FDA before. They sought advice as to how to best quantify and characterize the disease state and the unmet medical need — both for publications as well as to foster productive discussions with the FDA. Aquest recommended, designed, and helped implement a novel longitudinal patient registry to better characterize the disease lifecycle, burden, and costs. Data from the registry has been published and presented at scientific meetings and was well-received by the FDA.

10. Case Study

Patient reported outcome (PRO) end point development

View the Case

A clinical stage biotech company commissioned Aquest to manage (from a commercial point of view) the development of a novel PRO end point for their lead asset in a highly competitive therapeutic area. The effort involved many moving parts both internally (across several functional areas) and externally (related to content validation of the PRO across stakeholder groups in accordance with FDA guidance). Aquest’s contributions culminated in the assessment of novel ways of competitively differentiating the compound using the PRO as part of a composite end point.

11. Case Study

Disease summary creation

View the Case

An emerging, publicly traded specialty pharmaceutical company was preparing for a board meeting to discuss potential areas of investment. The client commissioned Aquest to develop concise, insightful disease summaries in neurology. Elements of each profile included disease definition and symptoms, patient population (prevalence), areas of unmet need, market size and growth trends, key products, companies and sales, key prescribers, competitor and pipeline analyses, and market insights. These summaries served as the basis for discussions and ultimately the selection of key disease areas and product development programs.

case studies

quick links

contact

NORTHERN CALIFORNIA

415.425.3201

mike@aquestconsulting.com

SOUTHERN CALIFORNIA

805.300.6912

reid@aquestresearch.com