Case Studies: Portfolio Planning / Indication Scans

Commercial

Strategy

Market

Research

Payer Strategy/

Reimbusement Planning

Business

Development

Competitive

Intelligence

Portfolio Planning/

Indication Scans

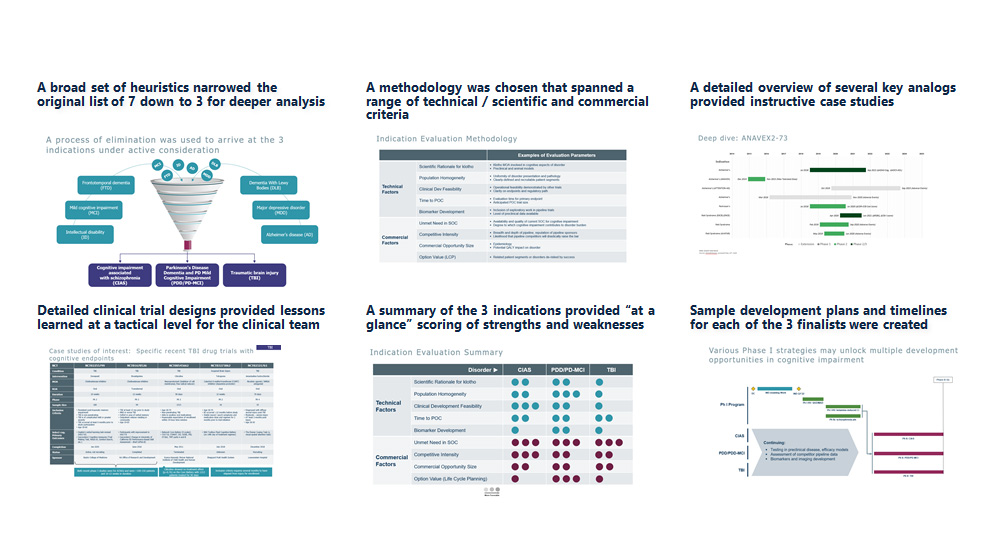

1. Case Study

Indication prioritization in CNS and neurodegenerative disease

The Problem

- A clinical stage newly public biotech client desired a quantitative indication prioritization methodology to guide clinical development of a promising early-stage agent with a novel CNS mechanism.

- Analysis should span technical / scientific, clinical, and commercial factors

- Indications being considered ranged from those with high prevalence and disparate etiologies to low prevalence with the potential for clean efficacy signal but potentially difficult trial recruitment

What We Did

- A broad set of heuristics and discussions with the research team narrowed the original list of 7 down to 3 for deeper analysis

- A range of research was conducted during the deep dive, including KOL interviews, a pipeline audit, review of trial results (benchmarking of lessons learned from recent clinical failures), and independent assessments of probabilities of success and feasibility

- Sample high-level development plans for each indication were also delivered

Our Results and Insights

- A broad set of heuristics narrowed the original list of 7 down to 3 for deeper analysis

- A methodology was chosen that spanned a range of technical / scientific and commercial criteria

- A detailed overview of several key analogs provided instructive case studies

- Detailed clinical trial designs provided lessons learned at a tactical level for the clinical team

- A summary of the 3 indications provided “at a glance” scoring of strengths and weaknesses

- Sample development plans and timelines for each of the 3 finalists were created

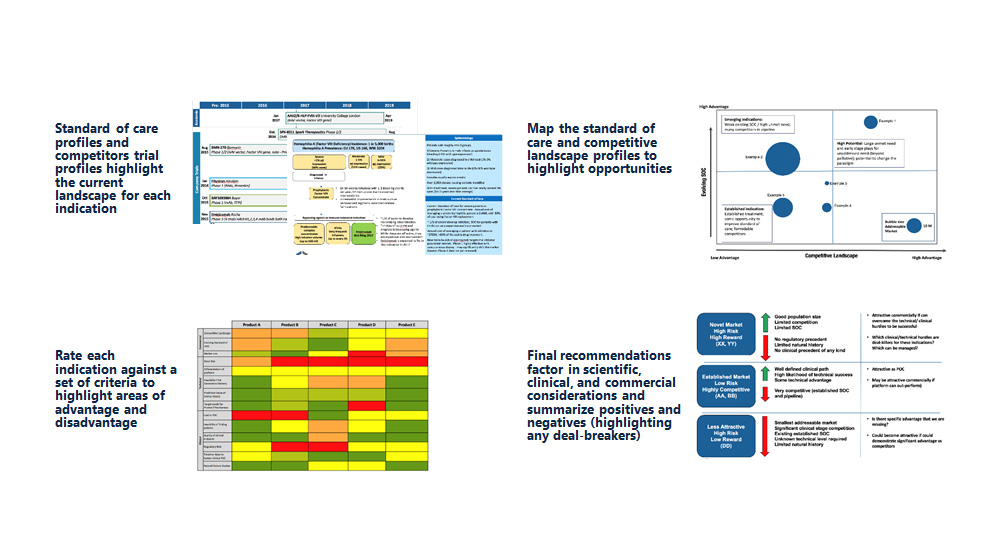

2. Case Study

Portfolio planning for an early stage platform company with a disruptive technology

The Problem

Client had a number of strategic portfolio questions, including:

- Which indications are best suited as a first indication for a new technology?

- How do commercial, technical, and clinical considerations inform this recommendation?

- Which phase 2 studies de-risk larger downstream opportunities?

- What makes the indication(s) compelling? What concerns should be addressed?

What We Did

- Established portfolio criteria and metrics based on technical, commercial and clinical considerations

- Researched and summarized the current state and evolving mid to late-stage pipeline of each indication

- Ranked and prioritized indications based on areas of advantage

- Recommended the top indications to pursue clinically

Our Results and Insights

- Standard of care profiles and competitors trial profiles highlight the current landscape for each indication

- Map the standard of care and competitive landscape profiles to highlight opportunities

- Rate each indication against a set of criteria to highlight areas of advantage and disadvantage

- Final recommendations factor in scientific, clinical, and commercial considerations and summarize positives and negatives (highlighting any deal-breakers)

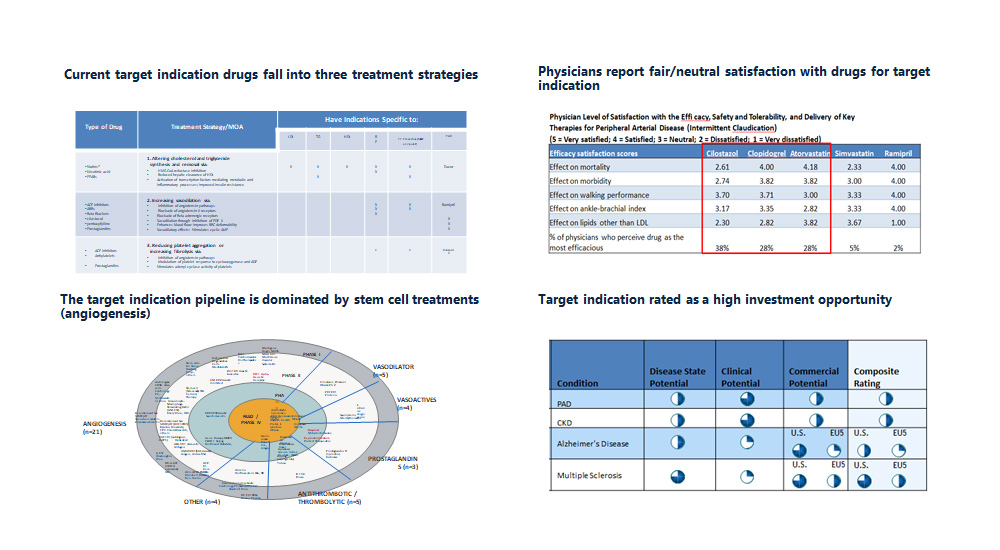

3. Case Study

Early-stage prioritization for novel mechanism for use in a range of cardiovascular indications

The Problem

- A top 10 global pharmaceutical company wanted to prioritize several potential secondary cardiovascular indications for a new atherosclerosis drug based on scientific, clinical, and commercial potential

- The target indication (of highest interest) is underdiagnosed and undertreated, despite high risk of cardiovascular events. Current SoC focuses on CV risk factor modification and MACE prevention; there are no treatments that prevent disease progression nor any that effectively treat symptomatic target indication

What We Did

- Secondary and primary research (KOLs, “trenches” physicians, payers) to characterize the potential for the Lp-PLA2 inhibitor in each indication

- Aquest recommended pursuing target indication, driven by strong clinical potential (unique MOA, potential to address underlying atherosclerosis, and potential to treat clinically meaningful symptoms)

- Client acted on recommendation in future development

Our Results and Insights

- Current target indication drugs fall into three treatment strategies

- Physicians report fair/neutral satisfaction with drugs for target indication

- The target indication pipeline is dominated by stem cell treatments (angiogenesis)

- Target indication rated as a high investment opportunity

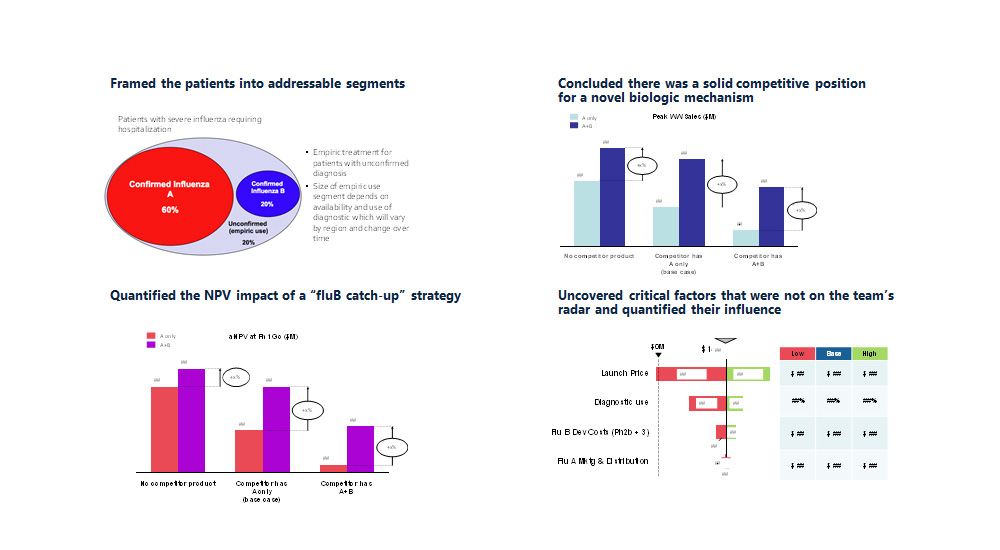

4. Case Study

Business case for a portfolio of novel anti-influenza biologics

The Problem

- A large global pharma company wanted to know how attractive the business case is for developing novel biologic drugs against influenza strains

- In addition, they sought to clarify the development strategy that would optimize the value of these assets

What We Did

- Led cross-functional team to build draft revenue forecast, create high-level clinical development plan, & assess technical risk

- Led meta-analysis efforts to determine potential hurdle values for novel clinical trial endpoints

- Led revenue and NPV investment scenario analysis to understand strategic implications

Our Results and Insights

- Framed the patients into addressable segments

- Concluded there was a solid competitive position for a novel biologic mechanism

- Quantified the NPV impact of a “fluB catch-up” strategy

- Uncovered critical factors that were not on the team’s radar and quantified their influence

5. Case Study

Analytical model for commercial risks to an oncology portfolio

The Problem

- A mid-size public biopharmaceutical company wanted to elucidate the largest IP-driven commercial risks to its oncology portfolio

- They also were interested in scenario planning, specifically around patent, exclusivity, targeted combination, formulation, & line extension assumptions

What We Did

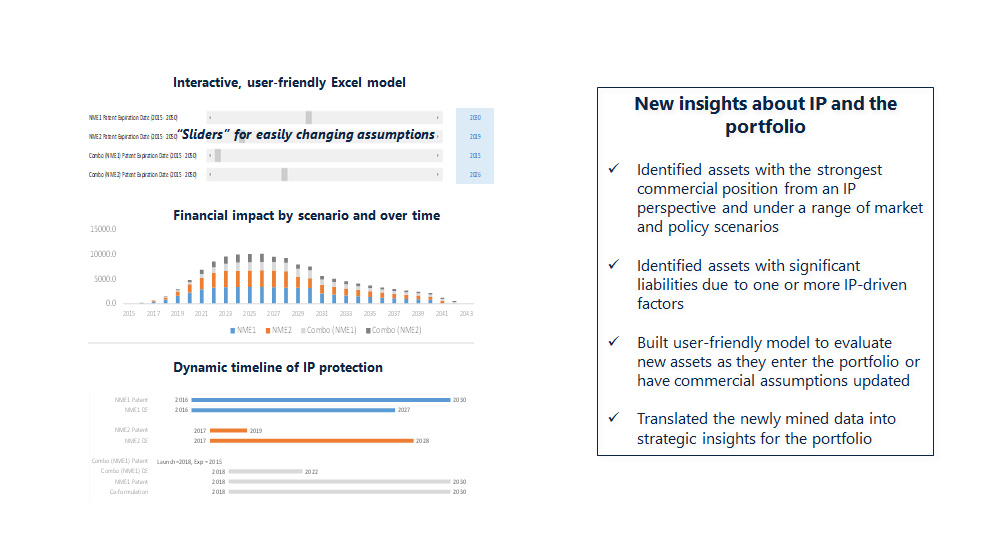

- Conducting a working session with client to distill their strategic priorities into a discrete set of project objectives that would give them the answer

- Created a user-friendly Excel model that could handle many IP, commercial, & global assumptions

- Mined sensitivity scenarios for new insights and strategic recommendations

Our Results and Insights

- Interactive, user-friendly Excel model

- Financial impact by scenario and over time

- Dynamic timeline of IP protection

New insights about IP and the portfolio

- Identified assets with the strongest commercial position from an IP perspective and under a range of market and policy scenarios

- Identified assets with significant liabilities due to one or more IP-driven factors

- Built user-friendly model to evaluate new assets as they enter the portfolio or have commercial assumptions updated

- Translated the newly mined data into strategic insights for the portfolio

6. Case Study

Portfolio planning and NPV modeling

View the Case Study

A mid-sized biotechnology company commissioned Aquest to create a valuation tool for its entire product portfolio. The bottom-up tool spanned 5 therapeutic areas and included development costs, patient demographics, diagnosis and treatment flow, share growth over time vs current and emerging competitors, persistence and compliance. The tool allowed scenario testing based on launch date (order of entry), price, competitor mix, and differing probabilities of technical success.

case studies

quick links

contact

NORTHERN CALIFORNIA

415.425.3201

mike@aquestconsulting.com

SOUTHERN CALIFORNIA

805.300.6912

reid@aquestresearch.com